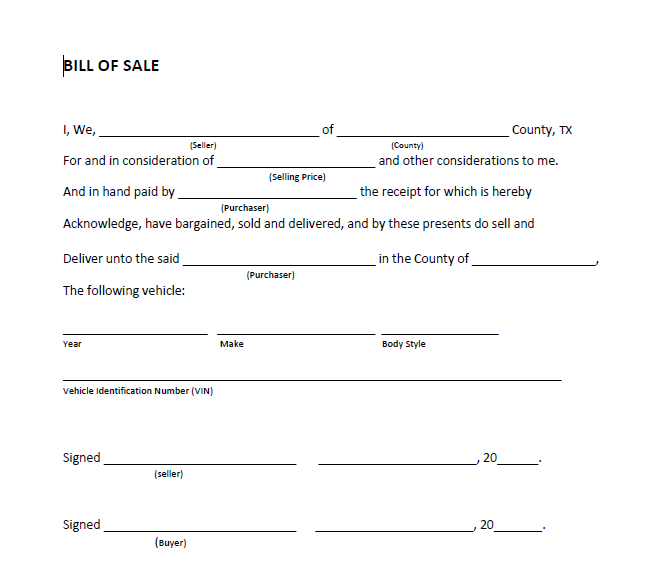

Topic: Insurance companies will ask for a bill of sale to remove a truck from my truck insurance policy.

This article is specific to Texas / TXDMV operating authority (known as TXD DOT #), but the same logic can be used when the motor carrier has a federal authority otherwise known as an MC Number.

First I will go over the legal obligation from an insurance company to the public and then I will go over WHY the most logical solution to this industry problem is a bill of sale.

When a motor carrier has an operating authority to operate in Texas (TXDMV number), the insurance company will file Form E with TXDMV. In summary, Form E establishes a legal obligation to the public, that financial responsibility (aka “insurance”) will be provided on behalf of the motor carrier. The keywords here are, to the public, not the motor carrier paying for the insurance. Also, notice how I did not specify that financial responsibility will be provided to the truck under the TXDMV number, but the TXDMV number in its entirety. In summary, by filing Form E, the insurance company could be making a promise to the public that they will pay for any accident with any truck operating under that TXDMV number.

Per the above, insurance companies are exposed to paying claims on trucks not listed on an insurance policy. Simply having that DOT numbers on the truck, implied dispatch, ownership of the truck, bill of lading or implied ownership, exposes the insurance company to pay the claim.

In times past, this has been taken advantage of by motor carriers. I have heard of trucker list 1 truck on their insurance policy and slap their TXDMV sticker on 5 trucks. I have seen insurance companies pay claims caused by 1 of the 4 trucks not listed.

Due to this abuse, insurance companies are resorting to harsh treatment towards their insureds. To remove a truck from an insurance policy, a bill of sale is needed out of fear that if a truck is removed, when driven (in the future), the insurance company is exposed to paying claims on that truck not insured. Insurance companies do random audits on public records to make sure other trucks are not owned, insurance companies keep tabs on DOT inspections to make sure no other trucks under that DOT number are stopped by DOT and will add a truck if one is found or request to cancel the policy.

All insurance companies in the industry require that the motor carrier list and insure (and pay for insurance) on all trucks owned and all trucks operated under the given authority. With the legal obligation they have towards the public by filings Form E, they’d be committing financial suicide if they did not.

The requirement of a bill of sale (in my opinion), makes the client aware of the seriousness of the situation and may legally limit the exposure to pay a claim caused by the truck (which was removed).

*** Note: if a truck is not owned, a de-lease agreement is acceptable to remove a truck. The same logic from above applies.

To all my clients,

Jesus R Olivares, Transportation Insurance Agent

*** My apologies for typos and syntax errors, I am a full-time insurance agent and need to write these articles as quick as I can to get back to advising my clients!

About The Author: Jesus Olivares

More posts by Jesus Olivares